How to choose a project?

Strategy and selection criteriaWhat projects are "normal"?

What does normal mean? Normal for whom? And what is an abnormal project? If a person asks such a question, it means they do not understand the main point: there are no normal or abnormal projects. 90% of projects in crypto are scams, useless projects that collect money on fabricated narratives for further embezzlement. What can I say - the entire Ethereum ecosystem is unviable and flawed, and the only thing left for investors is to inflate bubbles from L2 solutions to cash out.

What projects can be called normal? Is L0 normal? Maybe ZK? Maybe Starknet? So far, these coins are not "normal" because they haven't been distributed and are worth pennies. But once they soar on the news, the project will become "normal" again, and the community will proudly say, "I told you so — gem." There are no "normal" projects except those that feed us. So, having understood the term "normal," let's move on to how to choose projects that will "reward."

My experience shows that there is no clear strategy and dependency on different factors that determine whether a project will reward. That's basically it - reading further doesn't make sense as there won't be a perfect solution, and you'll have to think for yourself. I'll explain how I choose.

Funds

This factor is strong but not decisive. Of course, the richer and more reputable the fund, the higher the probability of distribution, as funds need to distribute first, then take back and pump their assets. The top distributors of airdrops are Polychain and Binance. If we consider funds like a16z, Paradigm, Multicoin, these funds enter long-term projects with a Tier-1 claim but don't always provide good rewards.

Technology

It's enough to read a short description of the project to understand how viable the project's idea is and whether it will be useful to the industry. Top projects will be those that massively attract liquidity to the market, optimize computing power, or work with AI. The more trending the direction, the higher the probability that the project will thrive and show good results.

Activities

I am very skeptical of projects that heavily push referral programs. For me, this is an indicator that the project invests in "buying" users rather than attracting adherents and evangelists of the project. We know how these referrals appear and what kind of audience they bring to the projects. Furthermore, if a project is heavily tied to quests and social media activities, it's a minus for me. It means I will spend hours engaging with social media instead of performing useful actions within the new blockchain. What benefit does the project get from me? Attracting other users, but not working on the technology and testing it.

Investments

Large investments do not equal large airdrops. As of July 2024, investment volumes in projects have significantly decreased due to regulation and MiCA (Markets in Crypto-Assets — a regulatory framework of the European Union aimed at regulating the crypto asset market). New projects understand their responsibility for the attracted funds and take less. Therefore, investments of $10 million are already considered large and interesting for project analysis. There were also projects that distributed good airdrops with investments of $4-6 million.

Number of Participants

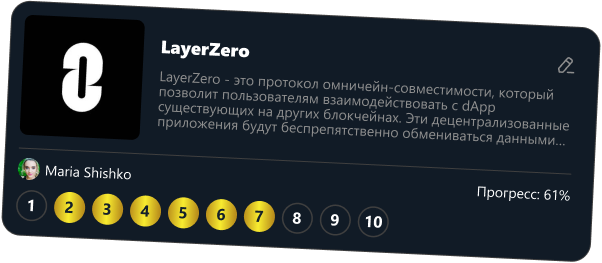

The fewer people, the more oxygen. Small projects benefit greatly from distributing airdrops. It's a way to showcase themselves, attract an audience, create hype, and, of course, distribute to themselves. I am interested in projects with 30-40 thousand participants, maximum 100 thousand. These are under-the-radar projects with simple actions that few people do because influencers don't write about them (of course, there is no fat referral program). The number of participants is easy to assess by social media, by Galxe. Understand, if there are 1 million retro hunters in the project, what are your chances of getting into the top 20 thousand to qualify for rewards?

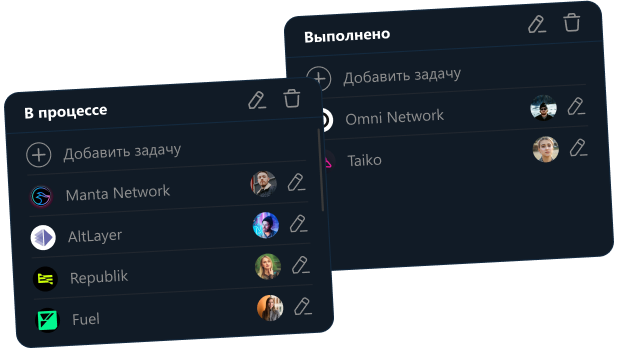

Automation Possibility

Small, unshielded projects can often be automated through BAS or Zennoposter. This means I can create many hundreds of wallets very cheaply, with minimal labor costs, and have a chance to receive an airdrop for activity. Not all will distribute, some may cut, but overall, the risk-reward ratio is very high. Therefore, automation in the testnet is a big plus for consideration.