What are sales and ICOs in crypto: how do rounds and allocations work, and where is the money? And a little terminology

ICO, IDO, IEO. Description and terminology.Important terms to understand

TGE "Token Generation Event" — the moment when tokens are generated through a smart contract and begin to be distributed to wallets. Most often coincides with listings

Allocation - the amount you are allowed to purchase tokens for in a sale or allocated for a drop

Whitelist - a list of wallets/accounts that are allowed to participate in sales or receive drops, mint NFT

Snapshot - a snapshot of your balance or activity for a specific period of time. It is then used to determine who is eligible to participate in the sale, receive a drop, or participate in other activities.

Vesting — a schedule for the gradual unlocking of tokens.

Cliff - a period when you receive nothing. The unlock only begins after the cliff ends

Listing — token release on the exchange

Launchpad — a platform where sales and project selection take place

Base: What are ICOs, sales, and why are they needed?

In crypto, the term "sales" usually refers to all formats of early token sales: ICO, IDO, IEO. They all have the same essence: the project sells some of its tokens before the project is fully launched, and investors try to get in at the earliest and cheapest price possible in order to later lock in their profits.

To put it simply: the project needs money for development, marketing, listings, etc. The investor needs to buy the asset well before the hype and sell it at a higher price after the TGE/listing.

ICO "Initial Coin Offering" is the early sale of project tokens to a limited circle of investors at a fixed price.

In essence, it is a cryptocurrency equivalent of crowdfunding: the project attracts money now and gives tokens in return.

It is important to understand: an ICO is not a "quick button for money." It is a high-risk stage of a startup. The project may only have an idea, a rough prototype, and a beautiful presentation, with no guarantee of success other than the metrics drawn up.

Pros and cons of participating in early sales

Pros

Early price. Tokens are sold significantly cheaper than after they hit the market.

Cons

The risk is zero. The project may not reach release.

In the early stages, there are few on-chain statistics and real metrics generated by thousands of farms. You have to trust the team, the documentation, and look at the partnerships being formed.

Don't forget about the risks of venture capital funds dumping shares.

If funds entered private rounds at a price significantly lower than yours and have an early lock-up period, they may dump the price

Main sale formats: how ICO, IDO, and IEO differ

These abbreviations are simply different ways to sell tokens at an early stage.

ICO — a classic early placement

Conducted on separate platforms or the project's own landing pages.

Retail access is possible, often through queues, whitelists, and with an eye on your wallet. IEO - placement through a centralized exchange.

IEO «Initial Exchange Offering» — сейл на CEX, таких как Binance, Kucoin, Gate.io и т. д

The exchange selects projects itself and conducts KYC/AML checks, which reduces the risk of outright scams.

It is often necessary to hold the exchange token in order to be eligible to participate, and listing usually takes place immediately after the sale ends. Allocations for retail can be very small due to high demand.

IDO - listing on DEX

IDO «Initial DEX Offering» - сейл через лаунчпад на DEX.

Everything works through smart contracts. Projects vary greatly in quality: from scams to real gems.

Rounds: who comes before you and at what prices

Before the public sale begins, the project has already distributed some of the tokens in the early stages.

Main types of rounds:

Pre-seed/Seed - the earliest investors, including angels and key partners. The lowest price, the longest vesting periods, and strict token locks

Private sale - funds, major influencers, strategic partners. The price is higher than at the seed stage, and the unlocking conditions are no less stringent than in seed rounds.

Public sale - the stage where retail appears. The price is already significantly higher, but vesting is usually softer or absent altogether

Plus, some of the tokens go here:

The team - they don't pay anything, but receive a share for their work and development of the project

Marketing and treasury – tokens for community drops, marketing, and future partnerships

I would like to point out one red flag: if the team has a fast token unlock, it is a sign that these tokens will appear on the market faster than they will begin to implement the ideas in the roadmap, and the project will not see any development.

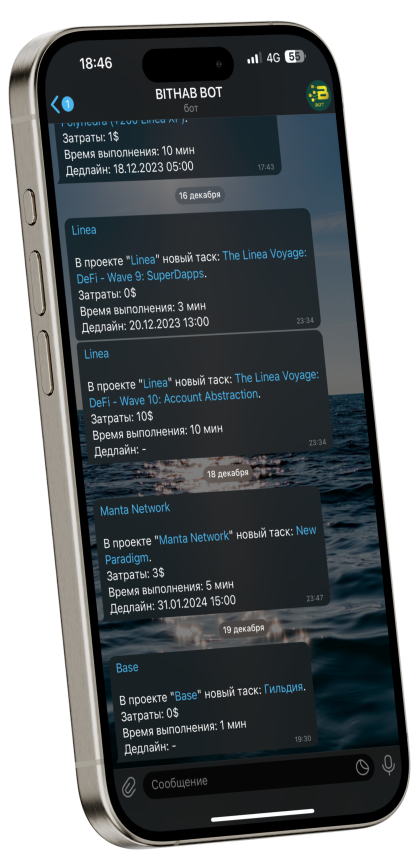

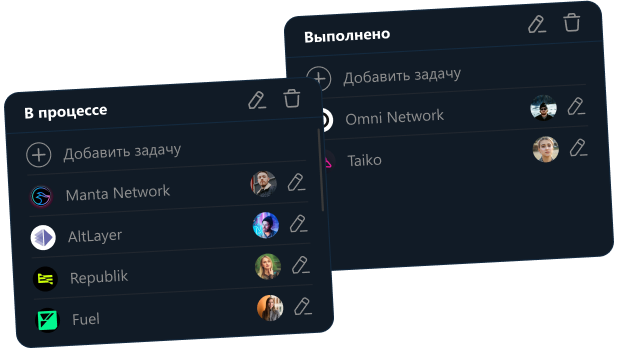

What does the usual mechanics of participating in sales look like?

Conditional scenario for an ICO/IEO/sale on a launchpad:

1) Register on the platform

Complete KYC, link your wallet or exchange account.

2) Register for a specific sale

There is often a registration window and additional conditions: hold the exchange token, have a minimum deposit, complete quests, etc.

3) Waiting for distribution

4) Receive or do not receive allocation

If everything is OK, your balance will be blocked for the duration of the sale, and then you will receive tokens at TGE or according to the vesting schedule.

A simple example with numbers

Let's say a hypothetical project sells

25,000,000 tokens on public sale

Price - $0.4 per token

Allocation per participant — up to $500

Theoretically, one person can purchase a maximum of 1,250 tokens = 500/0.4

If everyone buys the maximum amount, there will be enough tokens for approximately 20,000 people. In reality, some people will not make a purchase, while others will buy less, so the actual number may be slightly higher, but the order of magnitude is clear.

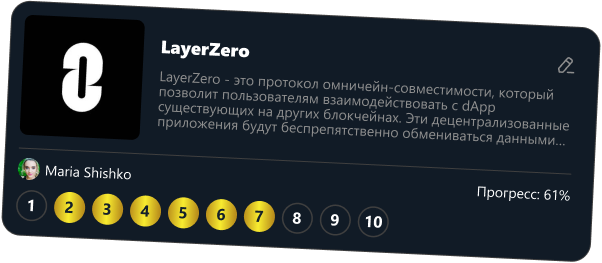

How to evaluate an ICO/sale before entering

Checks are not much different from token selection on the spot, but there are a couple of nuances.

Let's see:

Team and background.

Is there real experience, successful projects, real people, presence in the public sphere?

Roadmap

Is the plan realistic, and are the next steps clear?

Investors and rounds.

At what price did the funds enter?

When does their separation begin?

What will happen when your tokens are unlocked? Does this coincide with the unlocking of earlier rounds?

Tokenomics.

How are the shares distributed between the seed, private, public, and team, and how much is allocated to the rest?

If the team takes 60% at the start, this is clearly not a plus for trust.

Early investors got in 3-5 times cheaper and have a quick exit?

This is something to think about.

The logic of earning money: where is the profit here?

To simplify it into a formula:

1. The project raises money in early rounds.

2. You enter a public sale at price X.

3. The token enters the market

4. If demand is high and supply is limited by vesting, the price could go up 2x, 5x, 10x, or even higher.